If you only drive for personal reasons, personal auto insurance is usually enough. If you use your vehicle for work—like job sites, deliveries, or business errands—you may need commercial auto insurance. Choosing the right policy helps avoid denied claims.

Finding Car Insurance With a Bad Personal Auto vs Commercial Auto Insurance in Santa Ana California: Which Do You Need?

If you’ve ever Googled “Do I need commercial auto insurance?”—you’re not alone. Many drivers in Santa Ana and Orange County aren’t sure whether personal auto insurance is enough, especially if they use their car or truck for work sometimes.

Understanding personal auto vs commercial auto insurance in Santa Ana California comes down to one simple question:

👉 How do you actually use your vehicle?

What Is Personal Auto Insurance?

Personal auto insurance is for everyday driving, such as:

- Driving to and from work

- Grocery shopping

- School drop-offs

- Family trips

- Weekend errands

Simple Example

Ana lives in Santa Ana and drives her car to work, the store, and her kids’ school. She doesn’t use her car for work tasks or to make money.

✅ Personal auto insurance works for Ana.

What Is Commercial (Business) Auto Insurance?

Commercial auto insurance is for vehicles used for work or business, including:

- Driving to job sites

- Carrying tools or equipment

- Making deliveries

- Visiting customers or clients

- Vehicles owned by a business

Simple Example

Luis is a handyman in Orange County. He uses his truck to carry tools and drive to different jobs every day.

✅ Luis likely needs commercial auto insurance.

Why Personal Auto Insurance May Not Cover Work Use

Many drivers assume personal auto insurance covers “a little business driving.” In most cases, it doesn’t.

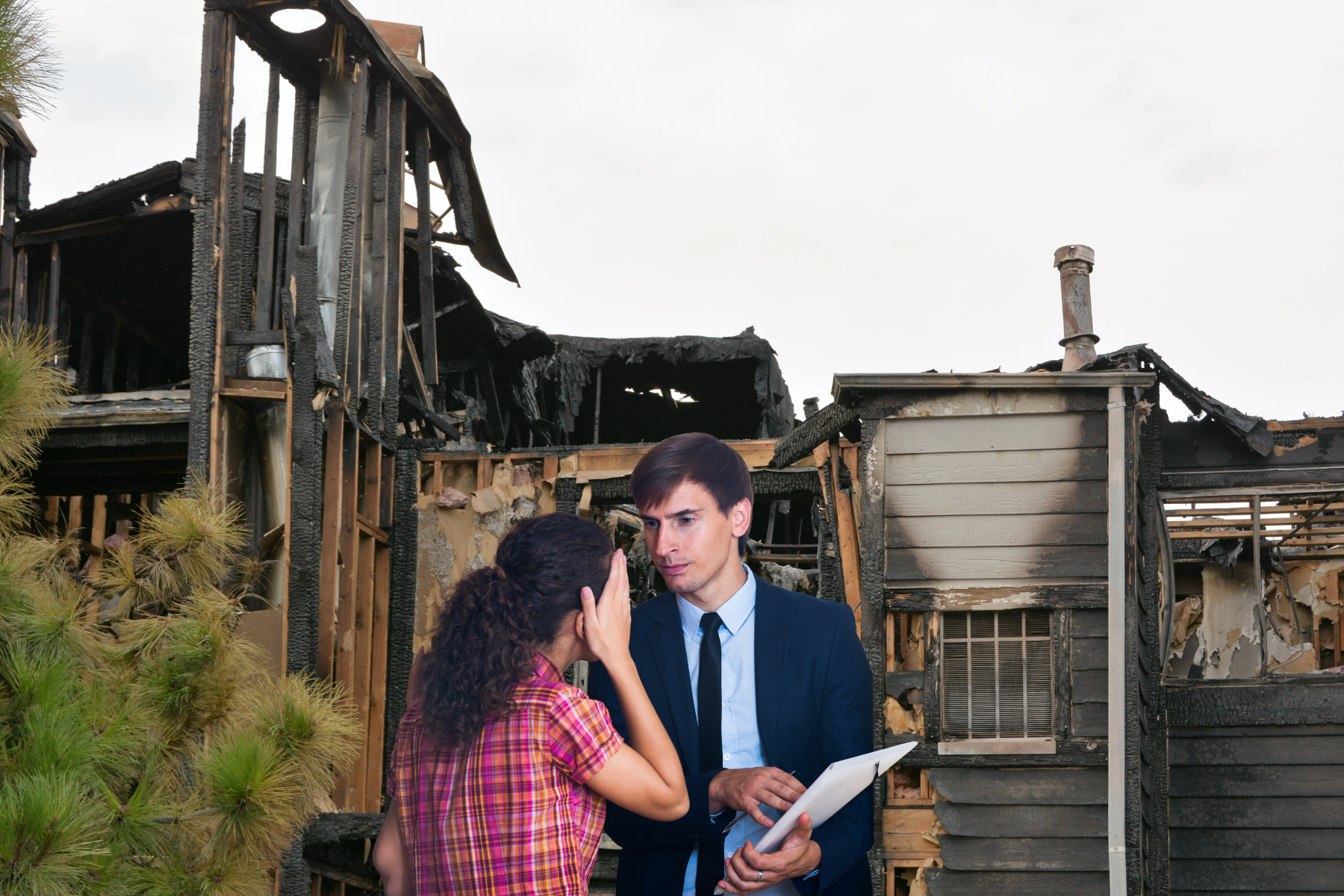

Real-Life Scenario

You get into an accident while driving to a job site or delivering supplies. If your insurer finds out the vehicle was being used for work and you only have personal auto insurance, your claim could be denied.

That’s why choosing the right coverage matters.

So… What Insurance Do You Actually Need?

You likely need personal auto insurance if:

- You only drive for personal reasons

- You don’t transport work tools or materials

- Your vehicle is not used to earn income

You likely need commercial auto insurance if:

- You’re self-employed or a contractor

- You use your vehicle for business errands

- You carry tools, equipment, or supplies

- Your vehicle is owned or registered to a business

Some drivers may need both, depending on how their vehicles are used.

Why Talking to a Local Agency Helps

Every driver’s situation is different, and California insurance rules can be confusing.

Established in 1989, Neighborhood Insurance Agency is a trusted local provider. We help drivers, contractors, and business owners in Santa Ana understand whether personal auto insurance, commercial auto insurance, or a combination is the right fit.

We don’t guess—we explain. Because choosing the right coverage is the key to your peace of mind.

👉 Get a quote or talk to us today.

Santa Ana, CA 92705

Reference

California Department of Insurance. (n.d.). Automobile insurance. California Department of Insurance. Retrieved from https://www.insurance.ca.gov/01-consumers/105-type/1-auto/

Insurance Information Institute. (2026). Facts + statistics: Auto insurance. Insurance Information Institute. Retrieved from https://www.iii.org/fact-statistic/facts-statistics-auto-insurance